Start by using our free tool to write a demand letter to a client with an unpaid invoice.

Start LetterContents

As a business owner, you trust your clients to pay you for services rendered or products delivered; the last thing you would like is a stack of outstanding invoices. Are you a business owner that is having trouble getting your clients to pay outstanding invoices? There are several steps you can take in order to receive payment for outstanding invoices.

Did you know we have a free tool powered by AI that helps you create a demand letter to a client who hasn't paid you? Check out our demand letter tool.

Here is video on how our demand letter tool works:

Steps to Take Before Suing Your Client for Outstanding Invoices in Small Claims Court

Step 1. Save All Evidence

You want to make sure to save all evidence related to the work you did for the client and any communication you had with client over unpaid invoices.

Here are some more examples of potential evidence:

The agreement or contract between you and your client for the work you did if it was in writing.

Any text messages, emails, or phone call logs between you and your client.

Any proof you have of how much your client owes you, when they were supposed to pay you, and any partial payments your clients have made.

If your client submitted a chargeback, gather all evidence of the chargeback (learn more about suing clients for chargebacks).

Step 2. Communicate with your clients via email or phone

Before suing your client in small claims court, try communicating with them via email or by phone and discuss any outstanding invoices or past due invoices. You may also want to mail the unpaid invoice again.

In your email, remind them that you depend on payment from clients to keep your business afloat. However, refrain from using anger as a way to get paid. A better strategy is to get your client to empathize with you over the problem.

Here are some examples of what you can say to clients with outstanding invoices:

"I completed the mural installation you requested three months ago, but I have not received payment from you. Were you thinking of paying the outstanding invoices soon? I am an independent artist with a small business and cannot continue to run my store without payments."

"I completed the deck in your house over a week ago but still haven't been paid. I was wondering when you would be able to pay me as I had to take out a loan to be able to pay my subcontractor on time."

"I completed the landscaping job on your backyard a few months ago and I was wondering when you were able to pay me. I am a small business owner and I really depend on my clients paying me. Without payments, I will have to close my business."

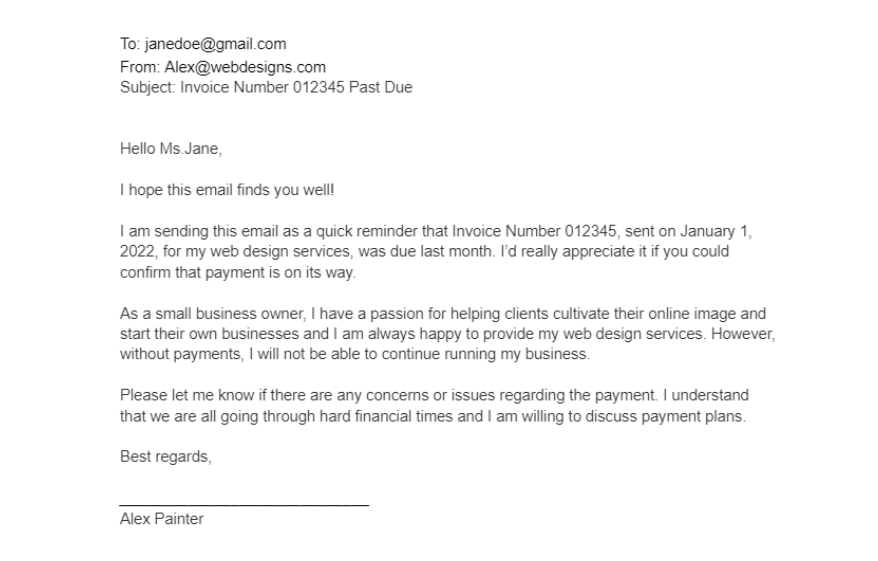

Sample email reminder for past due invoices

Below is a sample past due invoice email you can use as a template when reaching out to your clients. Make sure to add in all relevant information when actually sending your email. For example, in the subject line include the invoice number so your client knows which invoice is past due or outstanding. Overall you want to ensure your email is friendly, polite, and clearly explains why you are sending an email reminder.

Step 3. Send a Demand Letter

A demand letter is a letter that outlines a set of requests. For example, you could write a demand letter to your client requesting that they pay their outstanding invoices.

Consider sending a demand letter to help you resolve any outstanding invoices but also if you are considering filing a lawsuit in small claims court. Depending on the state you are filing a small claims lawsuit in you may be required to demand payment before filing. Sending a demand letter is an effective way of completing this requirement. Also, while you can make a demand orally, it is suggested you do so in writing. Sending a demand letter in writing ensures that your client understands how serious you are about getting your outstanding invoices paid.

Did you know we have a free tool powered by AI that helps you create a demand letter to a client who hasn't paid you? Check out our demand letter tool.

Learn more about writing a demand letter for payment to a client.

Step 4. Offer a Payment Plan

In the demand letter, add an option for payment plans if you think this will help your client make their outstanding payments. Most of the time, it is easier for people to pay in smaller installments rather than one larger lump sum.

For example, if your client owes you $1,500 for painting their entire house. This may be hard for your client to pay all at once but maybe they are able to pay $100 a week until the total $1,500 is paid.

It is also a good idea to ask them how much money they feel comfortable paying and when. If they say, “I can pay you $50 every 1st of the month”, then it was their idea how much they could pay you and when. It is easier to get "buy-in" from someone when it is their idea.

Step 5. Sue Your Client in Small Claims Court

Have you tried everything possible to get your client to pay past due invoices and you still have not been paid back? You may want to consider suing them in small claims court. Below are some general points about how to sue a client for unpaid invoices in small claims court.

How much can I sue a client for in small claims?

This is also known as the "small claims court limits." This limit varies from state to state, and can even vary from one court to another. Review our guide to small claims limits in all 50-states. For example, in California small claims if your business is a corporation or LLC, you can sue for $5,000 (if you are a sole proprietor meaning you didn’t incorporate your business, you can sue for $10,000).

What happens if I am owed more than what I can sue for?

You can still sue for the maximum amount allowed but you usually agree to waive any additional amount over the limit. For example, you are a carpenter and own a business that refurbishes and fixes people’s old furniture. One of your clients owes you $11,000 in outstanding invoices. In New York City small claims, the limit is $10,000, therefore you can sue in New York City small claims court for $10,000 and waive the remaining $1,000.

Why would I sue in small claims if I am owed more than the small claims limit?

Small claims court is generally quicker, and more affordable than filing your lawsuit in other types of courts, plus you generally don't need a lawyer to sue in small claims.

How much does it cost to sue a client in small claims for an unpaid invoice?

The amount you pay in fees to file a small claims lawsuit varies by state and sometimes even by court. Generally, you can expect to pay between $15-$75 to file a small claims case in most courts.

Check out our 50-State Guide to Small Claims Court to review filing fees by state.

How long do I have to sue my client in small claims court for an unpaid invoice?

There are deadlines for when you can sue a client.

Unpaid invoices would generally fall under the statute of limitations for breach of contract. When you look up the statute of limitations for your lawsuit against a client for outstanding invoices check what the breach of contract statute of limitations is in your state. In many states, there will be a difference between a contract that was in writing and a verbal contract.

Review our guide to statutes of limitations.

The Small Claims Court Hearing

Once you file your case, the court will set your hearing date and inform you and your client. During this time, you are still able to settle with your client. If your client repays you before the hearing date (or even on the hearing date), you can close the lawsuit.

To prepare for your small claims court hearing:

Prepare your evidence. You want to have your evidence organized with titles, dates, and why that piece of evidence is important. All your evidence should be geared towards showing the judge how much you are owed. Also, include any evidence of when your client was supposed to pay, and any money your client has already paid (if any). Make sure to include any contracts or invoices for the work you did for your client.

Prepare what to say. During the hearing, the judge will ask you why you are suing. For example, if you own a small architectural firm and you are suing one of your clients for unpaid invoices you will want to prepare a presentation that explains what services you provided your client, how much your services cost, and what you billed your client, and how much your client has paid or not paid.

Print enough copies of all your evidence. You will need at least three copies; one for you, one for the judge, and one for your client.

Check out our 50-State Guide to Small Claims Court.

Did you know we have a free tool powered by AI that helps you create a demand letter to a client who hasn't paid you? Check out our demand letter tool.

Claudia Diaz

Legal Educator @ People Clerk. Claudia holds a J.D. degree and is a certified mediator in New York and Florida. She has participated in dozens of small claims mediations in New York City courts.